SaaS Calculator

Customer Acquisition Cost (CAC) Calculator

Tracking customer acquisition cost accurately is a difficult business, especially if you have a blend of marketing channels. Use our simple calculator to get an estimate based on your actual data.

Your results

Your average Cost of Customer Acquisition is... $0

Your payback period is 0 months

How does customer acquisition cost (CAC) work?

A look at some of the principles behind CAC, CLV, LTV and all those other acronyms...

We can all agree that there are a lot of metrics to measure running ANY business.

But listen, customer acquisition cost (from here, 'CAC,' because let's face it, it's a mouthful...) is one of the most critical metrics out there.

Here's the bottom line:

Fail to understand it, and your business will sink.

Grasp it and work with it... And you'll be on a fast-track to success.

The CAC calculator above will give you a framework for working out a rough number for your business.

If you want to understand how to do this for yourself (with more accuracy), read on.

Why pay attention to CAC (and how to use the formula)

Business 101 says this:

If you've got a product, you need to sell it.

That means getting customers – and usually, you'll have to pay to get those customers.

That payment could take any form; it could be advertising on Facebook, buying ads through Google AdWords, sending out flyers to peoples' letterboxes or standing on a street corner trying to sign them up.

Whatever method you choose, you'll have to pay for it (yes... even the last one – it's a time cost!).

The AMOUNT you'll have to pay, at the most basic level, is your CAC. Spend $100 on Facebook to get your first customer? Your CAC is $100. Spend $100 on PPC and $50 on mailed flyers and end up with two customers? Your CAC is $75 ($150 / two customers).

This simple explanation illustrates the customer acquisition cost formula, which looks like this:

In our calculator above, you'll see that we've asked you to sum most of the core inputs into the CAC formula, but you could easily split out CAC by channel by dividing the total amount you spent on a single channel by the number of customers it produced.

Why customer lifetime value (LTV) is important

To build a viable business, your revenue from a customer MUST exceed the money that you spent to acquire that customer.

That's why you should pair CAC with LTV (and why we did above) – it's a measurement of profitability.

For many businesses, this might be very simple – if you sell cars, for instance, people will buy very infrequently and so the total value of that customer is probably just the profit on one car.

Example 1: An auto dealership

Let's imagine an auto dealership that sells ten cars a week, and never sees any repeat business.

Each car costs $15,000, and the profit the dealer will make on the vehicle is $3,000 – giving her a gross profit of $30,000.

However, to keep up that flow of car-buying customers, the dealer is spending $25,000 on newspaper ads every week.

Dividing that $25,000 by the ten customers means her CAC is $2500.

That's a thinner margin than we may have assumed on weekly revenues of $150,000 – because of the high CAC, her weekly profit is just $5000.

Or $500 per unit.

But for most businesses, people will buy more than once – either by visiting a store repeatedly or paying monthly on a credit card (as is the case for SaaS businesses).

Now the CAC calculation becomes more complicated because we have to work out the value of the customer through their entire life (known as lifetime value or customer lifetime value... or LTV or CLTV).

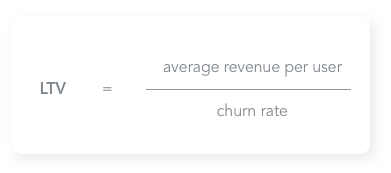

For SaaS businesses, LTV looks like this:

If you want more information on calculating LTV, we recommend theChartMogul Ultimate Guide to SaaS Customer Lifetime Value.

Example 2: A SaaS Business

Let's imagine a SaaS business which keeps its customers for 12 months, on average.

Now, every month, their customers pay them $100 on average, which means that over the lifetime of the customer, they will hand over an average of $1200.

Now imagine the company spent $1000 on marketing and related expenses last month, and acquired five customers, making their CAC $200.

Armed with these two figures (assuming the LTV doesn't change), we can infer that the profitability per customer is $1000.

For other types of business, there may be better ways to work out the total value of a customer over their time with the company or product.

A word about CAC in retail

Retailers tend to use advanced methods for calculating CAC because customer lifespans tend to be longer and the average spend tends to be shorter. If you imagine the number of times you'll pop into Target during your life (no matter where the location) and how much you'll spend there, you'll see how figuring out this amount of money can be crazy difficult.

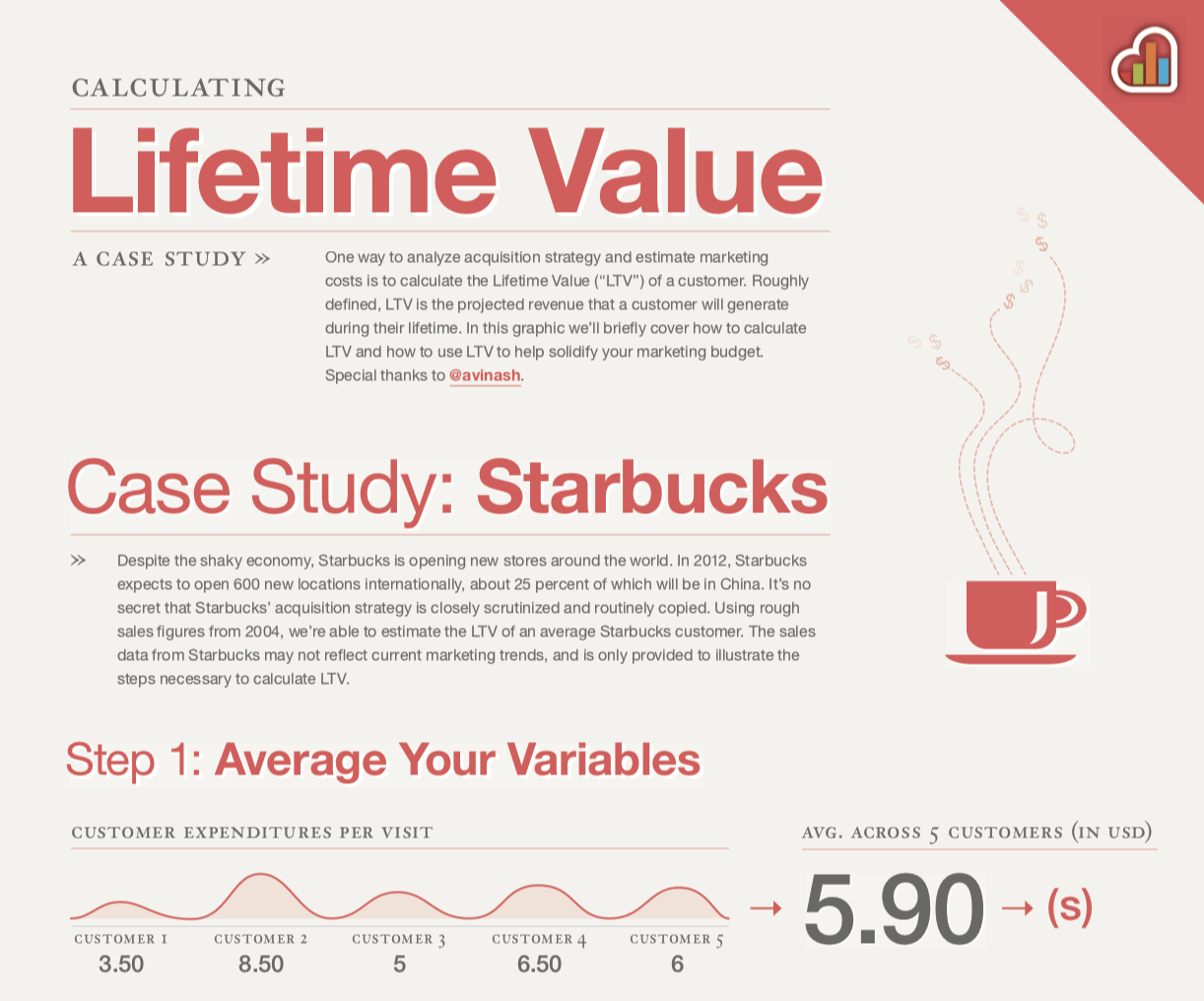

In thisfantastic PDF file,Kissmetrics and Avinash Kaushik have broken down the LTV calculation using Starbucks as an example.

Credit:Kissmetrics

Spoiler – the average customer is worth a whopping $14k to Starbucks over the course of their life, but the methodology used to reach that figure is worth paying attention to, especially as there are several potential formulae at play.

CAC Gotchas

If you want to calculate CAC using more than the simple calculator above, there are a couple of gotchas you should know.

First of all, CAC can have a LONG lead time. If you're selling cars, it could be three months between someone seeing your ads and finally buying the car. If you're looking at a month's worth of marketing expenditure and comparing it to that month of sales, you're doing something wrong.

Secondly, there are a bunch of costs that traditional calculators and formulas leave out – we've tried to include some in the calculator, but we won't have thought of all of them.

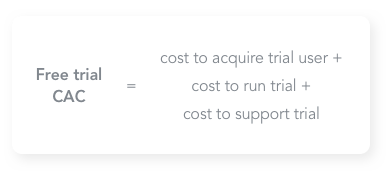

To produce an accurate CAC you need to factor in associated costs such as staff time, subscriptions to products related to marketing (web hosting, for instance), and other hidden expenses such as discounts you've offered in promotional materials or the support time that's gone into supporting somebody who's taken a free trial or test drive.

For example, there are multiple considerations in calculating the cost of customer acquisition for customers that joined via a free trial:

Thirdly, you'll need to know your customers very well.

This is a particular problem for bricks and mortar businesses, who don't always know when a customer first walked in and how many times they'll subsequently visit (see the Starbucks example above).

You'll need to decide on how to treat repeat customers in your CAC calculations – we'd typically err on the side of caution and discount them altogether. However, we'll cover this more in the next section...

What about repeat customers driven by the same marketing spend?

A common question when working with lifetime value is how to deal with customers that have been 'reactivated' by marketing.

For example, imagine a $100 ad for a bakery in a local newspaper results in two new customers, but it also prompts a customer who hasn't bought in the past two years to try the bakery again. How should we deal with this?

Technically CAC is the cost to acquire a NEW customer – for the purists out there, the repeat customer should be ignored altogether.

However, in the real world, that's not a fair calculation, and most business will apportion some of the ad spend as 'reactivation' spend. So, perhaps the total bill of $100 for the advert is discounted by 10%, meaning the CAC is $45 rather than $50 (because the ad spent to acquire those new customers is now $90).

The difficulty, especially offline, is knowing by how much to discount. Unless you know for sure that x% of the readership has already visited the bakery, it's nearly impossible to do – so you'll need to guess.

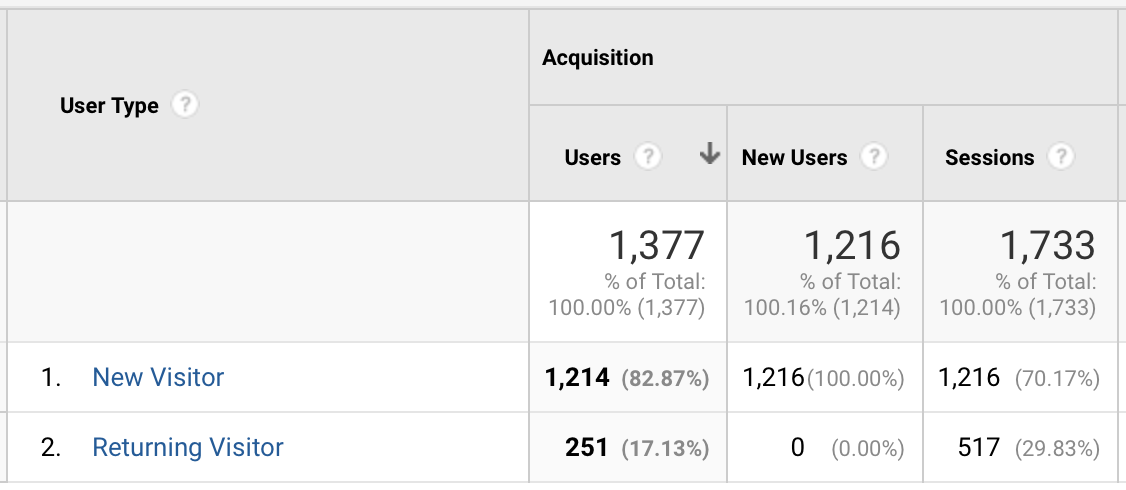

Online, things are a little easier, because most decent analytics software (including Google Analytics) can determine whether a visitor has been to the site before.

Google Analytics New vs Returning Report

So if a $100 Facebook advertising campaign yielded the same results, it would be reasonably easy to see that (for example) 20% of the traffic had already visited before and therefore only $80 of spending should be treated as 'new' CAC spend (giving us a CAC of $40).

Improving CAC and LTV

Basic maths tells us that we can improve a business's metrics in two ways – reducing the cost of customer acquisition or improving the lifetime value of the customer.

Improving CAC can be achieved by optimizing marketing spends, cutting down on wasteful channels, improving targeting, using more free or lower-cost distribution methods (e.g., viral content, partnerships or freemium offerings) or reducing the total hours-per-deal (to cut people costs).

Online businesses can also improve CAC by increasing the site conversion rate, which can be far more efficient than optimizing marketing spends.

For example, at a 5% conversion rate, 50 people will become customers for every 1000 visitors. If a visitor costs $3 on average, that's $3000 in marketing spend for 50 customers, which is a CAC of $60 per customer.

However, at a 6% conversion rate, 60 people will become customers for every 1000 visitors. Suddenly, the CAC drops to $50, a 16% fall. That's a far better way to improve CAC than by cutting marketing spend by 16%.

Ways to improve CAC

- Improve marketing spend efficiency

- Increase product virality

- Reduce sales/marketing staff expenses

- Conversion optimization

Improving lifetime value is a whole different ballgame – it's a metric that speaks to the quality of your relationship with the customer and how integral your business is to them.

Increasing the 'life' of the customer (also known as customer retention) is one way to tackle lifetime value improvement – stop a customer from churning so soon, and they'll spend more over their lifetime.

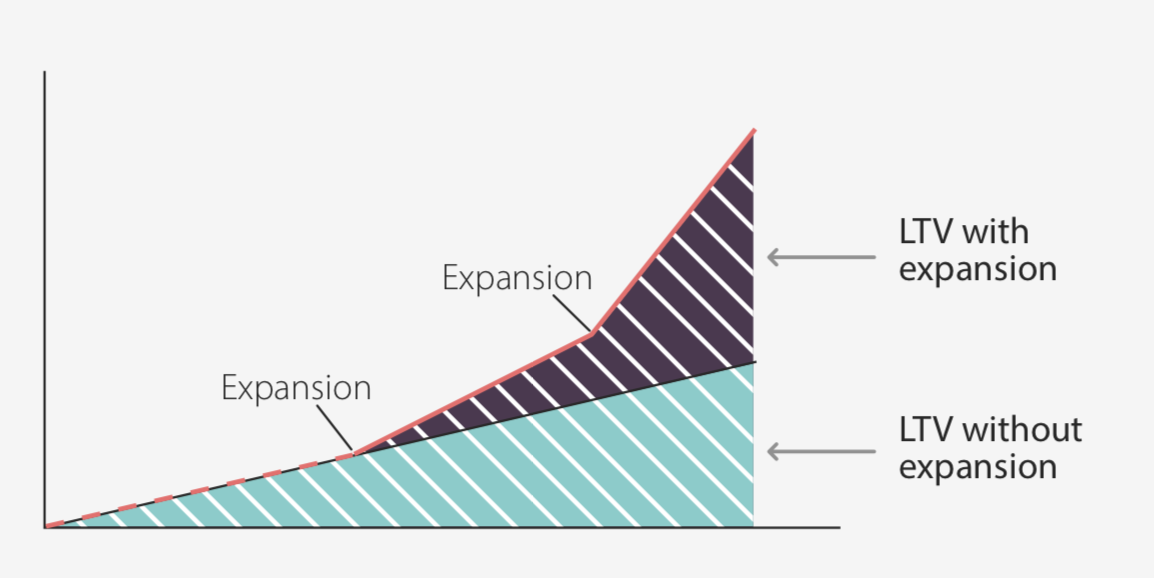

However, the best businesses combine increased retention with increased spend – steadily upselling over time, so that they grow more valuable to the company as they progress through their time as a customer.

Credit: Churnmetrics

If you signed up for a 'starter' bank account as a teenager and signed a mortgage loan with the same bank as an adult 20 years later, you've seen this in action. Teenagers are worth next to nothing as banking clients (as they have minimal deposits and no borrowing costs), but keeping that teenager around until they're ready to take out an $xxx,xxx loan with the bank is a smart move – which is why banks invest so much in stores like this to appeal to young adults:

Credit: FRANK by OCBC in Singapore

CAC:LTV: The Magic Ratio

In case we haven't labored the point enough, CAC needs to be measured against LTV to be useful – put together, they form a magic ratio which is useful as an internal metric and also as an indicator to evaluate the health of a business.

As a rule, investors will often look for a CAC to LTV ratio of three as a healthy number for a business – acquiring a customer shouldn't cost you more than a third of the revenue that customer generates.

At a number higher than three, there's probably room to grow, by investing in more marketing channels. At lower than three, margins are squeezed, and the total headroom for the business may be questioned.

Armed with all this theory, it shouldn't be a stretch to calculate your own CAC and LTV, whether you use the calculator above or not.

Hopefully, you can see that although nuance is required, CAC and LTV remain two of the most useful metrics businesses have.